Office

Categories

- All Collections

- 3M

- Air Cleaners, Fans, Heaters & Humidifiers

- Air Wick

- Apparel

- Appliances

- Arts & Crafts

- Audio Visual Equipment & Accessories

- Avery

- Backup Systems & Disks

- Bags

- Batteries & Electrical Supplies

- Best Sellers

- Beverages

- Beverages & Beverage Dispensers

- Bic

- Boards & Accessories

- Book Bags & Supply Cases

- Bookcases & Shelving

- Books, References & Study Aids

- Bounce

- Bounty

- Bowls & Plates

- Brands

- Breakroom Supplies

- Brooms, Brushes & Dusters

- Calculators

- Calendars, Planners & Personal Organizers

- Cameras, Camcorders & Accessories

- Candy

- Carts & Stands

- Cascade

- Cash Handling

- Chair Mats & Floor Mats

- Chairs, Stools & Seating Accessories

- Charmin

- Chemicals, Lubricants & Paints

- Chews

- Chocolate

- Cleaners & Detergents

- Cleaning Products

- Clorox

- Coffee

- Computer Cleaners

- Computer Hardware & Accessories

- Computer Keyboards & Mice

- Cookies

- Correction Supplies

- Cottonelle

- Crafts & Recreation Room Products

- Crayola

- Cups & Lids

- Cutlery

- Cutting & Measuring Devices

- Data Storage Media & Supplies

- Dawn

- Desk & Workstation Add-ons

- Desks & Workstations

- Desktop Tools & Accessories

- Dial

- Disposable

- Dixie

- Dove

- Downy

- Duracell

- Electronics

- Elmers

- Energizer

- Envelopes & Mail Supplies

- Everyday Essentials

- Facility Maintenance

- Faculty & Office Furniture

- Febreze

- File & Storage Cabinets

- First Aid & Health Supplies

- Floor & Carpet Care

- Folders

- Food

- Food Service

- Food Trays, Containers & Lids

- Food Warming

- Food Wraps

- Footrests & Foot Stools

- Forms, Recordkeeping & Reference Materials

- Furniture

- Gain

- Games, Toys & Manipulatives

- Garment Racks & Hangers

- General

- Glade

- Glassware

- Gloves & Glove Dispensers

- Gojo

- Guest & Reception Chairs

- Hand Sanitizers & Dispensers

- Hand Tools

- Hardware, Tools & Accessories

- Headphones

- Hefty

- Hot Deals

- Huggies

- Hvac

- Identification Badges

- Index Dividers

- Industrial

- Janitorial & Sanitation

- Kind

- Kitchen Supplies

- Kleenex

- Kotex

- Label Makers And Supplies

- Labels & Stickers

- Laminator & Laminator Supplies

- Laundry Products

- Lecterns

- Literature Racks & Display Cases

- Lysol

- Marking Tools

- Material Handling

- Matting

- Measuring & Leveling Tools

- Measuring Tools

- Milk Bone

- Miscellaneous

- Mobile Devices And Accessories

- Mops & Equipment

- Mouse Pads & Wrist Rests

- Mr Clean

- Mro Supplies

- Napkins, Dispensers & Towelettes

- Nestle

- Networking, Cables & Accessories

- Noodles

- Notebooks & Binders

- Odor Control

- Office

- Office Chairs

- Oxi Clean

- Pack & Ship

- Palmolive

- Pampers

- Paper & Printable Media

- Paper Pads

- Partitions & Panels

- Party Decorations

- Pens, Pencils, Highlighters & Markers

- Pentel

- Personal Hygiene Products

- Pine Sol

- Pizza Supplies

- Plumbing Equipment

- Presentation/display & Scheduling Boards

- Printer Supplies

- Printers & Copier/fax/multifunction Machines

- Printing Supplies

- Protein Bars

- Pumps

- Purell

- Reception Seating & Sofas

- Reference Books & Study Aides

- Restroom Cleaners & Accessories

- Reynolds

- Room Accessories

- Rubbermaid

- Rust Oleum

- Safety & Security

- Save Dollar Deal Choice

- School Supplies

- Scott

- Security And Surveillance Systems And Accessories

- Sharpie

- Shredders & Accessories

- Snacks

- Soaps & Dispensers

- Soft Scrub

- Sports & Phys Ed Equipment

- Stamps & Stamp Supplies

- Staplers & Punches

- Student Furniture

- Swiffer

- Table Service

- Tables

- Tags & Tickets

- Tape, Adhesives & Fasteners

- Teacher & Classroom Supplies

- Technology

- Technology & Electronics

- Telephones & Telephone Accessories

- Tide

- Towels, Tissues & Dispensers

- Transcription & Transcription Accessories

- Trash Bags, Can Liners & Dispensers

- Trucks, Carts & Dollies

- Typewriters & Typewriter Accessories

- Vehicle & Trailer Accessories

- Warewashing

- Warranties

- Waste Receptacles & Accessories

- Waste Receptacles & Lids

- WD-40

- Windex

- Writing & Correction Supplies

- Writing Pads & Self-stick Notes

- Zep

- Ziploc

$4.22

Satisfy IRS tax requirements with this form, used to report distributions from annuities, profit-sharing plans, retirement plans, IRAs, insurance contracts or pensions. One-part Federal Copy A laser cut sheet form. Laser/inkjet compatible. Printed in scannable red ink.

-

{"id":9860222517534,"title":"2023 1099-r Tax Form, 1 Part, Federal Copy, 2 Forms\/sheet, 50 Forms Total","handle":"2023-1099-r-tax-form-1-part-federal-copy-2-forms-sheet-50-forms-total","description":"Satisfy IRS tax requirements with this form, used to report distributions from annuities, profit-sharing plans, retirement plans, IRAs, insurance contracts or pensions. One-part Federal Copy A laser cut sheet form. Laser\/inkjet compatible. Printed in scannable red ink.","published_at":"2025-09-14T19:07:59-05:00","created_at":"2025-09-14T19:07:58-05:00","vendor":"Adams®","type":"Office","tags":["0%","1099-R","2","50","8.5\" x 11\"","Black","Forms","Inkjet","Laser","M","N","Preprinted Top Left","Recordkeeping \u0026 Reference Materials","Red","Tax Forms","Unbound","White"],"price":422,"price_min":422,"price_max":422,"available":true,"price_varies":false,"compare_at_price":null,"compare_at_price_min":0,"compare_at_price_max":0,"compare_at_price_varies":false,"variants":[{"id":50144604389662,"title":"Default Title","option1":"Default Title","option2":null,"option3":null,"sku":"ESTOP920103","requires_shipping":true,"taxable":true,"featured_image":null,"available":true,"name":"2023 1099-r Tax Form, 1 Part, Federal Copy, 2 Forms\/sheet, 50 Forms Total","public_title":null,"options":["Default Title"],"price":422,"weight":3810,"compare_at_price":null,"inventory_management":"shopify","barcode":"087958145601","requires_selling_plan":false,"selling_plan_allocations":[]}],"images":[],"featured_image":null,"options":["Title"],"requires_selling_plan":false,"selling_plan_groups":[],"content":"Satisfy IRS tax requirements with this form, used to report distributions from annuities, profit-sharing plans, retirement plans, IRAs, insurance contracts or pensions. One-part Federal Copy A laser cut sheet form. Laser\/inkjet compatible. Printed in scannable red ink."}

-

{"id":9860222517534,"title":"2023 1099-r Tax Form, 1 Part, Federal Copy, 2 Forms\/sheet, 50 Forms Total","handle":"2023-1099-r-tax-form-1-part-federal-copy-2-forms-sheet-50-forms-total","description":"Satisfy IRS tax requirements with this form, used to report distributions from annuities, profit-sharing plans, retirement plans, IRAs, insurance contracts or pensions. One-part Federal Copy A laser cut sheet form. Laser\/inkjet compatible. Printed in scannable red ink.","published_at":"2025-09-14T19:07:59-05:00","created_at":"2025-09-14T19:07:58-05:00","vendor":"Adams®","type":"Office","tags":["0%","1099-R","2","50","8.5\" x 11\"","Black","Forms","Inkjet","Laser","M","N","Preprinted Top Left","Recordkeeping \u0026 Reference Materials","Red","Tax Forms","Unbound","White"],"price":422,"price_min":422,"price_max":422,"available":true,"price_varies":false,"compare_at_price":null,"compare_at_price_min":0,"compare_at_price_max":0,"compare_at_price_varies":false,"variants":[{"id":50144604389662,"title":"Default Title","option1":"Default Title","option2":null,"option3":null,"sku":"ESTOP920103","requires_shipping":true,"taxable":true,"featured_image":null,"available":true,"name":"2023 1099-r Tax Form, 1 Part, Federal Copy, 2 Forms\/sheet, 50 Forms Total","public_title":null,"options":["Default Title"],"price":422,"weight":3810,"compare_at_price":null,"inventory_management":"shopify","barcode":"087958145601","requires_selling_plan":false,"selling_plan_allocations":[]}],"images":[],"featured_image":null,"options":["Title"],"requires_selling_plan":false,"selling_plan_groups":[],"content":"Satisfy IRS tax requirements with this form, used to report distributions from annuities, profit-sharing plans, retirement plans, IRAs, insurance contracts or pensions. One-part Federal Copy A laser cut sheet form. Laser\/inkjet compatible. Printed in scannable red ink."}

$4.28

Three-up blank forms can be used for W-2 or 1099 printing. Laser/inkjet printer compatible. Online access to Adams Tax Forms Helper® sold separately. Meets IRS specifications.

-

{"id":9860217962782,"title":"2024 W-2 Or 1099 Blank 3-up Laser\/inkjet Forms, 8.5 X 3.66, 3 Forms\/sheet, 102 Forms Total","handle":"2024-w-2-or-1099-blank-3-up-laser-inkjet-forms-8-5-x-3-66-3-forms-sheet-102-forms-total","description":"Three-up blank forms can be used for W-2 or 1099 printing. Laser\/inkjet printer compatible. Online access to Adams Tax Forms Helper® sold separately. Meets IRS specifications.","published_at":"2025-09-14T18:40:36-05:00","created_at":"2025-09-14T18:40:35-05:00","vendor":"Adams®","type":"Office","tags":["0%","102","1099","3","8.5\" x 11\"","8.5\" x 3.66\"","Forms","M","N","Recordkeeping \u0026 Reference Materials","Tax Forms","Three Up","Unbound","Vertical","W-2","White"],"price":428,"price_min":428,"price_max":428,"available":true,"price_varies":false,"compare_at_price":null,"compare_at_price_min":0,"compare_at_price_max":0,"compare_at_price_varies":false,"variants":[{"id":50144585777438,"title":"Default Title","option1":"Default Title","option2":null,"option3":null,"sku":"ESTOP411965","requires_shipping":true,"taxable":true,"featured_image":null,"available":true,"name":"2024 W-2 Or 1099 Blank 3-up Laser\/inkjet Forms, 8.5 X 3.66, 3 Forms\/sheet, 102 Forms Total","public_title":null,"options":["Default Title"],"price":428,"weight":186,"compare_at_price":null,"inventory_management":"shopify","barcode":"087958100136","requires_selling_plan":false,"selling_plan_allocations":[]}],"images":[],"featured_image":null,"options":["Title"],"requires_selling_plan":false,"selling_plan_groups":[],"content":"Three-up blank forms can be used for W-2 or 1099 printing. Laser\/inkjet printer compatible. Online access to Adams Tax Forms Helper® sold separately. Meets IRS specifications."}

-

{"id":9860217962782,"title":"2024 W-2 Or 1099 Blank 3-up Laser\/inkjet Forms, 8.5 X 3.66, 3 Forms\/sheet, 102 Forms Total","handle":"2024-w-2-or-1099-blank-3-up-laser-inkjet-forms-8-5-x-3-66-3-forms-sheet-102-forms-total","description":"Three-up blank forms can be used for W-2 or 1099 printing. Laser\/inkjet printer compatible. Online access to Adams Tax Forms Helper® sold separately. Meets IRS specifications.","published_at":"2025-09-14T18:40:36-05:00","created_at":"2025-09-14T18:40:35-05:00","vendor":"Adams®","type":"Office","tags":["0%","102","1099","3","8.5\" x 11\"","8.5\" x 3.66\"","Forms","M","N","Recordkeeping \u0026 Reference Materials","Tax Forms","Three Up","Unbound","Vertical","W-2","White"],"price":428,"price_min":428,"price_max":428,"available":true,"price_varies":false,"compare_at_price":null,"compare_at_price_min":0,"compare_at_price_max":0,"compare_at_price_varies":false,"variants":[{"id":50144585777438,"title":"Default Title","option1":"Default Title","option2":null,"option3":null,"sku":"ESTOP411965","requires_shipping":true,"taxable":true,"featured_image":null,"available":true,"name":"2024 W-2 Or 1099 Blank 3-up Laser\/inkjet Forms, 8.5 X 3.66, 3 Forms\/sheet, 102 Forms Total","public_title":null,"options":["Default Title"],"price":428,"weight":186,"compare_at_price":null,"inventory_management":"shopify","barcode":"087958100136","requires_selling_plan":false,"selling_plan_allocations":[]}],"images":[],"featured_image":null,"options":["Title"],"requires_selling_plan":false,"selling_plan_groups":[],"content":"Three-up blank forms can be used for W-2 or 1099 printing. Laser\/inkjet printer compatible. Online access to Adams Tax Forms Helper® sold separately. Meets IRS specifications."}

$13.14

Get the forms you need to file W-2s for up to 300 employees. 2024 Blank W-2 Forms have Copy B instructions printed on the back; micro perforations spilt into three forms per sheet. 2024 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by...

-

{"id":9860214620446,"title":"2024 W-2 3-up Employee Copy Blank Front With Copy B Backers; 8.5 X 3.66, 3 Forms\/sheet, 300 Forms Total","handle":"2024-w-2-3-up-employee-copy-blank-front-with-copy-b-backers-8-5-x-3-66-3-forms-sheet-300-forms-total","description":"Get the forms you need to file W-2s for up to 300 employees. 2024 Blank W-2 Forms have Copy B instructions printed on the back; micro perforations spilt into three forms per sheet. 2024 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by January 31, 2025; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper® to eFile to the IRS\/SSA.","published_at":"2025-09-14T18:15:28-05:00","created_at":"2025-09-14T18:15:27-05:00","vendor":"Adams®","type":"Office","tags":["0%","2024","3","8.5\" x 11\"","8.5\" x 3.66\"","Black","Forms","Inkjet","Laser","M","N","Recordkeeping \u0026 Reference Materials","Tax Forms","Three Up","Unbound","Vertical","W-2","White","Yes"],"price":1314,"price_min":1314,"price_max":1314,"available":true,"price_varies":false,"compare_at_price":null,"compare_at_price_min":0,"compare_at_price_max":0,"compare_at_price_varies":false,"variants":[{"id":50144572342558,"title":"Default Title","option1":"Default Title","option2":null,"option3":null,"sku":"ESTFP420066","requires_shipping":true,"taxable":true,"featured_image":null,"available":true,"name":"2024 W-2 3-up Employee Copy Blank Front With Copy B Backers; 8.5 X 3.66, 3 Forms\/sheet, 300 Forms Total","public_title":null,"options":["Default Title"],"price":1314,"weight":499,"compare_at_price":null,"inventory_management":"shopify","barcode":"087958100105","requires_selling_plan":false,"selling_plan_allocations":[]}],"images":[],"featured_image":null,"options":["Title"],"requires_selling_plan":false,"selling_plan_groups":[],"content":"Get the forms you need to file W-2s for up to 300 employees. 2024 Blank W-2 Forms have Copy B instructions printed on the back; micro perforations spilt into three forms per sheet. 2024 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by January 31, 2025; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper® to eFile to the IRS\/SSA."}

-

{"id":9860214620446,"title":"2024 W-2 3-up Employee Copy Blank Front With Copy B Backers; 8.5 X 3.66, 3 Forms\/sheet, 300 Forms Total","handle":"2024-w-2-3-up-employee-copy-blank-front-with-copy-b-backers-8-5-x-3-66-3-forms-sheet-300-forms-total","description":"Get the forms you need to file W-2s for up to 300 employees. 2024 Blank W-2 Forms have Copy B instructions printed on the back; micro perforations spilt into three forms per sheet. 2024 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by January 31, 2025; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper® to eFile to the IRS\/SSA.","published_at":"2025-09-14T18:15:28-05:00","created_at":"2025-09-14T18:15:27-05:00","vendor":"Adams®","type":"Office","tags":["0%","2024","3","8.5\" x 11\"","8.5\" x 3.66\"","Black","Forms","Inkjet","Laser","M","N","Recordkeeping \u0026 Reference Materials","Tax Forms","Three Up","Unbound","Vertical","W-2","White","Yes"],"price":1314,"price_min":1314,"price_max":1314,"available":true,"price_varies":false,"compare_at_price":null,"compare_at_price_min":0,"compare_at_price_max":0,"compare_at_price_varies":false,"variants":[{"id":50144572342558,"title":"Default Title","option1":"Default Title","option2":null,"option3":null,"sku":"ESTFP420066","requires_shipping":true,"taxable":true,"featured_image":null,"available":true,"name":"2024 W-2 3-up Employee Copy Blank Front With Copy B Backers; 8.5 X 3.66, 3 Forms\/sheet, 300 Forms Total","public_title":null,"options":["Default Title"],"price":1314,"weight":499,"compare_at_price":null,"inventory_management":"shopify","barcode":"087958100105","requires_selling_plan":false,"selling_plan_allocations":[]}],"images":[],"featured_image":null,"options":["Title"],"requires_selling_plan":false,"selling_plan_groups":[],"content":"Get the forms you need to file W-2s for up to 300 employees. 2024 Blank W-2 Forms have Copy B instructions printed on the back; micro perforations spilt into three forms per sheet. 2024 W-2 forms must be mailed or eFiled to the SSA and furnished to your employees by January 31, 2025; IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use Adams Tax Forms Helper® to eFile to the IRS\/SSA."}

$32.33

Cover your IRS Form 1099-DIV needs with the TOPS™ Five-Part 1099-DIV Tax Form Kit. Kit includes five-part 1099-DIV form sets, 1096 summary forms and enough envelopes for your recipients. Use 1099-DIV to detail gross dividends and other distributions valued at $10 or more on stock investment expenses, capital gain dividends,...

-

{"id":9834315448606,"title":"Five-part 1099-div Tax Form Kit For Inkjet\/laser Printers, Five-part Carbonless, 8.5 X 5.5, 2 Forms\/sheet, 100 Forms Total","handle":"five-part-1099-div-tax-form-kit-for-inkjet-laser-printers-five-part-carbonless-8-5-x-5-5-2-forms-sheet-100-forms-total","description":"Cover your IRS Form 1099-DIV needs with the TOPS™ Five-Part 1099-DIV Tax Form Kit. Kit includes five-part 1099-DIV form sets, 1096 summary forms and enough envelopes for your recipients. Use 1099-DIV to detail gross dividends and other distributions valued at $10 or more on stock investment expenses, capital gain dividends, non-taxable distributions and liquidation distributions. As of 2022, Form 1099-DIV is an IRS continuous-use form, with a fill-in-the-year date field that makes it suitable for multiple tax years. The IRS will no longer issue annual revisions to these forms and instructions. All TOPS™ tax forms employ acid-free paper and heat-resistant inks to help you produce smudge-free, archival-safe tax forms with the scannable red ink required by the IRS for paper filing. Forms meet all IRS specifications. Compatible with QuickBooks® and other accounting software packages.\u003cbr\u003e\u003cb\u003ePackage Includes:\u003c\/b\u003e (100) Envelopes; (3) 1096 Summary \u0026amp; Transmittal Forms","published_at":"2025-08-19T18:25:05-05:00","created_at":"2025-08-19T18:25:05-05:00","vendor":"TOPS™","type":"Office","tags":["(100) Envelopes","(3) 1096 Summary \u0026 Transmittal Forms","0%","100","1096","1099-DIV","1099-DIV Dividends and Distributions","2","8.5 x 11","8.5 x 5.5","Black","Five-Part Carbonless","For Inkjet \u0026 Laser Printers","Forms","Inkjet","Laser","M","N","No","Recordkeeping \u0026 Reference Materials","Red","Tax Forms","Unbound","Vertical: Two Down","White"],"price":3233,"price_min":3233,"price_max":3233,"available":true,"price_varies":false,"compare_at_price":null,"compare_at_price_min":0,"compare_at_price_max":0,"compare_at_price_varies":false,"variants":[{"id":50062761787678,"title":"Default Title","option1":"Default Title","option2":null,"option3":null,"sku":"ESTOPLDIV4KITS","requires_shipping":true,"taxable":true,"featured_image":null,"available":true,"name":"Five-part 1099-div Tax Form Kit For Inkjet\/laser Printers, Five-part Carbonless, 8.5 X 5.5, 2 Forms\/sheet, 100 Forms Total","public_title":null,"options":["Default Title"],"price":3233,"weight":1833,"compare_at_price":null,"inventory_management":"shopify","barcode":"087958490046","requires_selling_plan":false,"selling_plan_allocations":[]}],"images":[],"featured_image":null,"options":["Title"],"requires_selling_plan":false,"selling_plan_groups":[],"content":"Cover your IRS Form 1099-DIV needs with the TOPS™ Five-Part 1099-DIV Tax Form Kit. Kit includes five-part 1099-DIV form sets, 1096 summary forms and enough envelopes for your recipients. Use 1099-DIV to detail gross dividends and other distributions valued at $10 or more on stock investment expenses, capital gain dividends, non-taxable distributions and liquidation distributions. As of 2022, Form 1099-DIV is an IRS continuous-use form, with a fill-in-the-year date field that makes it suitable for multiple tax years. The IRS will no longer issue annual revisions to these forms and instructions. All TOPS™ tax forms employ acid-free paper and heat-resistant inks to help you produce smudge-free, archival-safe tax forms with the scannable red ink required by the IRS for paper filing. Forms meet all IRS specifications. Compatible with QuickBooks® and other accounting software packages.\u003cbr\u003e\u003cb\u003ePackage Includes:\u003c\/b\u003e (100) Envelopes; (3) 1096 Summary \u0026amp; Transmittal Forms"}

-

{"id":9834315448606,"title":"Five-part 1099-div Tax Form Kit For Inkjet\/laser Printers, Five-part Carbonless, 8.5 X 5.5, 2 Forms\/sheet, 100 Forms Total","handle":"five-part-1099-div-tax-form-kit-for-inkjet-laser-printers-five-part-carbonless-8-5-x-5-5-2-forms-sheet-100-forms-total","description":"Cover your IRS Form 1099-DIV needs with the TOPS™ Five-Part 1099-DIV Tax Form Kit. Kit includes five-part 1099-DIV form sets, 1096 summary forms and enough envelopes for your recipients. Use 1099-DIV to detail gross dividends and other distributions valued at $10 or more on stock investment expenses, capital gain dividends, non-taxable distributions and liquidation distributions. As of 2022, Form 1099-DIV is an IRS continuous-use form, with a fill-in-the-year date field that makes it suitable for multiple tax years. The IRS will no longer issue annual revisions to these forms and instructions. All TOPS™ tax forms employ acid-free paper and heat-resistant inks to help you produce smudge-free, archival-safe tax forms with the scannable red ink required by the IRS for paper filing. Forms meet all IRS specifications. Compatible with QuickBooks® and other accounting software packages.\u003cbr\u003e\u003cb\u003ePackage Includes:\u003c\/b\u003e (100) Envelopes; (3) 1096 Summary \u0026amp; Transmittal Forms","published_at":"2025-08-19T18:25:05-05:00","created_at":"2025-08-19T18:25:05-05:00","vendor":"TOPS™","type":"Office","tags":["(100) Envelopes","(3) 1096 Summary \u0026 Transmittal Forms","0%","100","1096","1099-DIV","1099-DIV Dividends and Distributions","2","8.5 x 11","8.5 x 5.5","Black","Five-Part Carbonless","For Inkjet \u0026 Laser Printers","Forms","Inkjet","Laser","M","N","No","Recordkeeping \u0026 Reference Materials","Red","Tax Forms","Unbound","Vertical: Two Down","White"],"price":3233,"price_min":3233,"price_max":3233,"available":true,"price_varies":false,"compare_at_price":null,"compare_at_price_min":0,"compare_at_price_max":0,"compare_at_price_varies":false,"variants":[{"id":50062761787678,"title":"Default Title","option1":"Default Title","option2":null,"option3":null,"sku":"ESTOPLDIV4KITS","requires_shipping":true,"taxable":true,"featured_image":null,"available":true,"name":"Five-part 1099-div Tax Form Kit For Inkjet\/laser Printers, Five-part Carbonless, 8.5 X 5.5, 2 Forms\/sheet, 100 Forms Total","public_title":null,"options":["Default Title"],"price":3233,"weight":1833,"compare_at_price":null,"inventory_management":"shopify","barcode":"087958490046","requires_selling_plan":false,"selling_plan_allocations":[]}],"images":[],"featured_image":null,"options":["Title"],"requires_selling_plan":false,"selling_plan_groups":[],"content":"Cover your IRS Form 1099-DIV needs with the TOPS™ Five-Part 1099-DIV Tax Form Kit. Kit includes five-part 1099-DIV form sets, 1096 summary forms and enough envelopes for your recipients. Use 1099-DIV to detail gross dividends and other distributions valued at $10 or more on stock investment expenses, capital gain dividends, non-taxable distributions and liquidation distributions. As of 2022, Form 1099-DIV is an IRS continuous-use form, with a fill-in-the-year date field that makes it suitable for multiple tax years. The IRS will no longer issue annual revisions to these forms and instructions. All TOPS™ tax forms employ acid-free paper and heat-resistant inks to help you produce smudge-free, archival-safe tax forms with the scannable red ink required by the IRS for paper filing. Forms meet all IRS specifications. Compatible with QuickBooks® and other accounting software packages.\u003cbr\u003e\u003cb\u003ePackage Includes:\u003c\/b\u003e (100) Envelopes; (3) 1096 Summary \u0026amp; Transmittal Forms"}

$4.22

1098 Mortgage Interest Tax Forms detail the amount of interest and mortgage-related expenses paid on a mortgage during the tax year.

-

{"id":9834294640926,"title":"1098 Mortgage Interest Tax Form, Fiscal Year: 2021, One-part (no Copies), 8 X 5.5, 2 Forms\/sheet, 50 Forms Total","handle":"1098-mortgage-interest-tax-form-fiscal-year-2021-one-part-no-copies-8-x-5-5-2-forms-sheet-50-forms-total","description":"1098 Mortgage Interest Tax Forms detail the amount of interest and mortgage-related expenses paid on a mortgage during the tax year.","published_at":"2025-08-19T17:08:59-05:00","created_at":"2025-08-19T17:08:59-05:00","vendor":"TOPS™","type":"Office","tags":["0%","1098","1098 Mortgage Interest Statement","2","2021","50","8 x 5.5","8.5 x 11","Forms","Inkjet","Laser","M","N","One-Part (No Copies)","Recordkeeping \u0026 Reference Materials","Red","Tax Forms","Unbound","Vertical: Two Down","White","Yes"],"price":422,"price_min":422,"price_max":422,"available":true,"price_varies":false,"compare_at_price":null,"compare_at_price_min":0,"compare_at_price_max":0,"compare_at_price_varies":false,"variants":[{"id":50062708867358,"title":"Default Title","option1":"Default Title","option2":null,"option3":null,"sku":"ESTOPL1098FEDS","requires_shipping":true,"taxable":true,"featured_image":null,"available":true,"name":"1098 Mortgage Interest Tax Form, Fiscal Year: 2021, One-part (no Copies), 8 X 5.5, 2 Forms\/sheet, 50 Forms Total","public_title":null,"options":["Default Title"],"price":422,"weight":281,"compare_at_price":null,"inventory_management":"shopify","barcode":"087958010985","requires_selling_plan":false,"selling_plan_allocations":[]}],"images":[],"featured_image":null,"options":["Title"],"requires_selling_plan":false,"selling_plan_groups":[],"content":"1098 Mortgage Interest Tax Forms detail the amount of interest and mortgage-related expenses paid on a mortgage during the tax year."}

-

{"id":9834294640926,"title":"1098 Mortgage Interest Tax Form, Fiscal Year: 2021, One-part (no Copies), 8 X 5.5, 2 Forms\/sheet, 50 Forms Total","handle":"1098-mortgage-interest-tax-form-fiscal-year-2021-one-part-no-copies-8-x-5-5-2-forms-sheet-50-forms-total","description":"1098 Mortgage Interest Tax Forms detail the amount of interest and mortgage-related expenses paid on a mortgage during the tax year.","published_at":"2025-08-19T17:08:59-05:00","created_at":"2025-08-19T17:08:59-05:00","vendor":"TOPS™","type":"Office","tags":["0%","1098","1098 Mortgage Interest Statement","2","2021","50","8 x 5.5","8.5 x 11","Forms","Inkjet","Laser","M","N","One-Part (No Copies)","Recordkeeping \u0026 Reference Materials","Red","Tax Forms","Unbound","Vertical: Two Down","White","Yes"],"price":422,"price_min":422,"price_max":422,"available":true,"price_varies":false,"compare_at_price":null,"compare_at_price_min":0,"compare_at_price_max":0,"compare_at_price_varies":false,"variants":[{"id":50062708867358,"title":"Default Title","option1":"Default Title","option2":null,"option3":null,"sku":"ESTOPL1098FEDS","requires_shipping":true,"taxable":true,"featured_image":null,"available":true,"name":"1098 Mortgage Interest Tax Form, Fiscal Year: 2021, One-part (no Copies), 8 X 5.5, 2 Forms\/sheet, 50 Forms Total","public_title":null,"options":["Default Title"],"price":422,"weight":281,"compare_at_price":null,"inventory_management":"shopify","barcode":"087958010985","requires_selling_plan":false,"selling_plan_allocations":[]}],"images":[],"featured_image":null,"options":["Title"],"requires_selling_plan":false,"selling_plan_groups":[],"content":"1098 Mortgage Interest Tax Forms detail the amount of interest and mortgage-related expenses paid on a mortgage during the tax year."}

$29.47

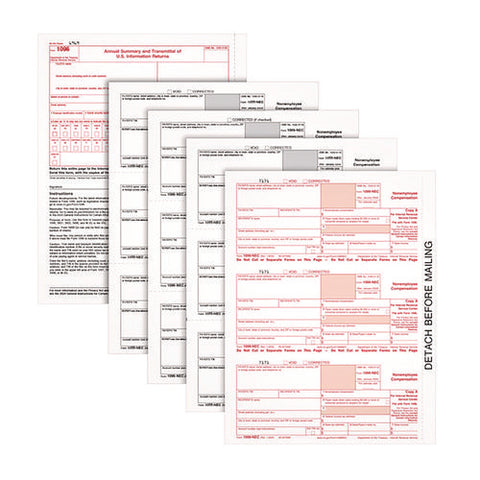

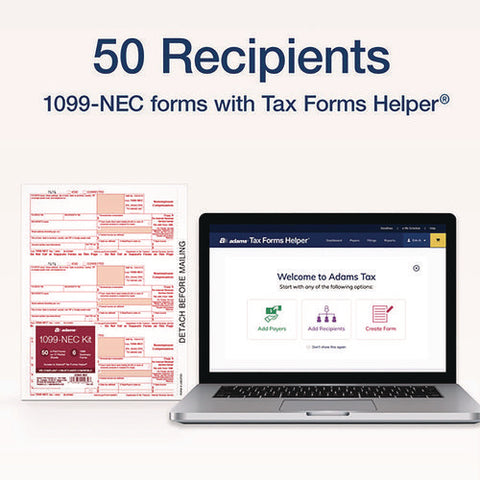

Get what you need to report nonemployee compensation with four-part 1099-NEC form sets, 1096 summary forms and access to Tax Forms Helper®, the fast and easy way to file. In just a few clicks, Tax Forms Helper® allows you to upload your 1099-NEC data directly from QuickBooks® Online or import...

-

{"id":9512458977566,"title":"4-part 1099-nec Tax Forms With Tax Forms Helper, Fiscal Year: 2024, Carbonless, 8.5 X 3.5, 3 Forms\/sheet, 50 Forms Total","handle":"4-part-1099-nec-tax-forms-with-tax-forms-helper-fiscal-year-2024-carbonless-8-5-x-3-5-3-forms-sheet-50-forms-total","description":"Get what you need to report nonemployee compensation with four-part 1099-NEC form sets, 1096 summary forms and access to Tax Forms Helper®, the fast and easy way to file. In just a few clicks, Tax Forms Helper® allows you to upload your 1099-NEC data directly from QuickBooks® Online or import your details from a previous year. Use 1099-NEC forms to report nonemployee compensation paid to independent contractors and attorneys; and as of 2022, the IRS has made the 1099-NEC a continuous-use form with a fill-in-the-year date field, making it good for multiple tax years. Per the 2023 IRS eFile law, if you're filing 10 or more forms, you'll need to eFile, and Tax Forms Helper® makes it easy to comply with a secure IRS\/SSA eFile system. Starting in 2024, the IRS has also removed Copy-C from the 1099-NEC, so use Helper to save digital copies, too!\u003cbr\u003e\u003cb\u003ePackage Includes:\u003c\/b\u003e (3) 1096 Summary \u0026amp; Transmittal Forms","published_at":"2024-09-26T21:46:16-05:00","created_at":"2024-09-26T21:46:19-05:00","vendor":"Adams®","type":"Office","tags":["(3) 1096 Summary \u0026 Transmittal Forms","0%","1096","1096 Annual Summary and Transmittal of U.S. Information Returns","1099-NEC","2024","3","50","8.5 x 11","8.5 x 3.5","Black","Forms","Four-Part Carbonless","Inkjet","Laser","M","N","Recordkeeping \u0026 Reference Materials","Red","Tax Forms","Unbound","Undated","Vertical: Three Down","White"],"price":2947,"price_min":2947,"price_max":2947,"available":true,"price_varies":false,"compare_at_price":null,"compare_at_price_min":0,"compare_at_price_max":0,"compare_at_price_varies":false,"variants":[{"id":49208778883358,"title":"Default Title","option1":"Default Title","option2":null,"option3":null,"sku":"ESTOP22993NEC","requires_shipping":true,"taxable":true,"featured_image":{"id":47629369016606,"product_id":9512458977566,"position":1,"created_at":"2024-09-26T21:46:19-05:00","updated_at":"2024-09-26T21:46:19-05:00","alt":null,"width":500,"height":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC.jpg?v=1727405179","variant_ids":[49208778883358]},"available":true,"name":"4-part 1099-nec Tax Forms With Tax Forms Helper, Fiscal Year: 2024, Carbonless, 8.5 X 3.5, 3 Forms\/sheet, 50 Forms Total","public_title":null,"options":["Default Title"],"price":2947,"weight":653,"compare_at_price":null,"inventory_management":"shopify","barcode":"025932229398","featured_media":{"alt":null,"id":39893007270174,"position":1,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC.jpg?v=1727405179"}},"requires_selling_plan":false,"selling_plan_allocations":[]}],"images":["\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC.jpg?v=1727405179","\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_1.jpg?v=1727405183","\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_8.jpg?v=1727405184","\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_4.jpg?v=1727405187","\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_2.jpg?v=1727405189","\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_7.jpg?v=1727405191","\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_5.jpg?v=1727405194","\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_3.jpg?v=1727405196","\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_6.jpg?v=1727405197"],"featured_image":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC.jpg?v=1727405179","options":["Title"],"media":[{"alt":null,"id":39893007270174,"position":1,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC.jpg?v=1727405179"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC.jpg?v=1727405179","width":500},{"alt":null,"id":39893007401246,"position":2,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_1.jpg?v=1727405183"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_1.jpg?v=1727405183","width":500},{"alt":null,"id":39893007499550,"position":3,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_8.jpg?v=1727405184"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_8.jpg?v=1727405184","width":500},{"alt":null,"id":39893007827230,"position":4,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_4.jpg?v=1727405187"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_4.jpg?v=1727405187","width":500},{"alt":null,"id":39893007859998,"position":5,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_2.jpg?v=1727405189"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_2.jpg?v=1727405189","width":500},{"alt":null,"id":39893007958302,"position":6,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_7.jpg?v=1727405191"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_7.jpg?v=1727405191","width":500},{"alt":null,"id":39893008089374,"position":7,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_5.jpg?v=1727405194"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_5.jpg?v=1727405194","width":500},{"alt":null,"id":39893008351518,"position":8,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_3.jpg?v=1727405196"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_3.jpg?v=1727405196","width":500},{"alt":null,"id":39893008384286,"position":9,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_6.jpg?v=1727405197"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_6.jpg?v=1727405197","width":500}],"requires_selling_plan":false,"selling_plan_groups":[],"content":"Get what you need to report nonemployee compensation with four-part 1099-NEC form sets, 1096 summary forms and access to Tax Forms Helper®, the fast and easy way to file. In just a few clicks, Tax Forms Helper® allows you to upload your 1099-NEC data directly from QuickBooks® Online or import your details from a previous year. Use 1099-NEC forms to report nonemployee compensation paid to independent contractors and attorneys; and as of 2022, the IRS has made the 1099-NEC a continuous-use form with a fill-in-the-year date field, making it good for multiple tax years. Per the 2023 IRS eFile law, if you're filing 10 or more forms, you'll need to eFile, and Tax Forms Helper® makes it easy to comply with a secure IRS\/SSA eFile system. Starting in 2024, the IRS has also removed Copy-C from the 1099-NEC, so use Helper to save digital copies, too!\u003cbr\u003e\u003cb\u003ePackage Includes:\u003c\/b\u003e (3) 1096 Summary \u0026amp; Transmittal Forms"}

-

{"id":9512458977566,"title":"4-part 1099-nec Tax Forms With Tax Forms Helper, Fiscal Year: 2024, Carbonless, 8.5 X 3.5, 3 Forms\/sheet, 50 Forms Total","handle":"4-part-1099-nec-tax-forms-with-tax-forms-helper-fiscal-year-2024-carbonless-8-5-x-3-5-3-forms-sheet-50-forms-total","description":"Get what you need to report nonemployee compensation with four-part 1099-NEC form sets, 1096 summary forms and access to Tax Forms Helper®, the fast and easy way to file. In just a few clicks, Tax Forms Helper® allows you to upload your 1099-NEC data directly from QuickBooks® Online or import your details from a previous year. Use 1099-NEC forms to report nonemployee compensation paid to independent contractors and attorneys; and as of 2022, the IRS has made the 1099-NEC a continuous-use form with a fill-in-the-year date field, making it good for multiple tax years. Per the 2023 IRS eFile law, if you're filing 10 or more forms, you'll need to eFile, and Tax Forms Helper® makes it easy to comply with a secure IRS\/SSA eFile system. Starting in 2024, the IRS has also removed Copy-C from the 1099-NEC, so use Helper to save digital copies, too!\u003cbr\u003e\u003cb\u003ePackage Includes:\u003c\/b\u003e (3) 1096 Summary \u0026amp; Transmittal Forms","published_at":"2024-09-26T21:46:16-05:00","created_at":"2024-09-26T21:46:19-05:00","vendor":"Adams®","type":"Office","tags":["(3) 1096 Summary \u0026 Transmittal Forms","0%","1096","1096 Annual Summary and Transmittal of U.S. Information Returns","1099-NEC","2024","3","50","8.5 x 11","8.5 x 3.5","Black","Forms","Four-Part Carbonless","Inkjet","Laser","M","N","Recordkeeping \u0026 Reference Materials","Red","Tax Forms","Unbound","Undated","Vertical: Three Down","White"],"price":2947,"price_min":2947,"price_max":2947,"available":true,"price_varies":false,"compare_at_price":null,"compare_at_price_min":0,"compare_at_price_max":0,"compare_at_price_varies":false,"variants":[{"id":49208778883358,"title":"Default Title","option1":"Default Title","option2":null,"option3":null,"sku":"ESTOP22993NEC","requires_shipping":true,"taxable":true,"featured_image":{"id":47629369016606,"product_id":9512458977566,"position":1,"created_at":"2024-09-26T21:46:19-05:00","updated_at":"2024-09-26T21:46:19-05:00","alt":null,"width":500,"height":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC.jpg?v=1727405179","variant_ids":[49208778883358]},"available":true,"name":"4-part 1099-nec Tax Forms With Tax Forms Helper, Fiscal Year: 2024, Carbonless, 8.5 X 3.5, 3 Forms\/sheet, 50 Forms Total","public_title":null,"options":["Default Title"],"price":2947,"weight":653,"compare_at_price":null,"inventory_management":"shopify","barcode":"025932229398","featured_media":{"alt":null,"id":39893007270174,"position":1,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC.jpg?v=1727405179"}},"requires_selling_plan":false,"selling_plan_allocations":[]}],"images":["\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC.jpg?v=1727405179","\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_1.jpg?v=1727405183","\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_8.jpg?v=1727405184","\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_4.jpg?v=1727405187","\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_2.jpg?v=1727405189","\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_7.jpg?v=1727405191","\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_5.jpg?v=1727405194","\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_3.jpg?v=1727405196","\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_6.jpg?v=1727405197"],"featured_image":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC.jpg?v=1727405179","options":["Title"],"media":[{"alt":null,"id":39893007270174,"position":1,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC.jpg?v=1727405179"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC.jpg?v=1727405179","width":500},{"alt":null,"id":39893007401246,"position":2,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_1.jpg?v=1727405183"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_1.jpg?v=1727405183","width":500},{"alt":null,"id":39893007499550,"position":3,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_8.jpg?v=1727405184"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_8.jpg?v=1727405184","width":500},{"alt":null,"id":39893007827230,"position":4,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_4.jpg?v=1727405187"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_4.jpg?v=1727405187","width":500},{"alt":null,"id":39893007859998,"position":5,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_2.jpg?v=1727405189"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_2.jpg?v=1727405189","width":500},{"alt":null,"id":39893007958302,"position":6,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_7.jpg?v=1727405191"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_7.jpg?v=1727405191","width":500},{"alt":null,"id":39893008089374,"position":7,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_5.jpg?v=1727405194"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_5.jpg?v=1727405194","width":500},{"alt":null,"id":39893008351518,"position":8,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_3.jpg?v=1727405196"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_3.jpg?v=1727405196","width":500},{"alt":null,"id":39893008384286,"position":9,"preview_image":{"aspect_ratio":1.0,"height":500,"width":500,"src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_6.jpg?v=1727405197"},"aspect_ratio":1.0,"height":500,"media_type":"image","src":"\/\/savedollardeals.com\/cdn\/shop\/files\/ESTOP22993NEC_6.jpg?v=1727405197","width":500}],"requires_selling_plan":false,"selling_plan_groups":[],"content":"Get what you need to report nonemployee compensation with four-part 1099-NEC form sets, 1096 summary forms and access to Tax Forms Helper®, the fast and easy way to file. In just a few clicks, Tax Forms Helper® allows you to upload your 1099-NEC data directly from QuickBooks® Online or import your details from a previous year. Use 1099-NEC forms to report nonemployee compensation paid to independent contractors and attorneys; and as of 2022, the IRS has made the 1099-NEC a continuous-use form with a fill-in-the-year date field, making it good for multiple tax years. Per the 2023 IRS eFile law, if you're filing 10 or more forms, you'll need to eFile, and Tax Forms Helper® makes it easy to comply with a secure IRS\/SSA eFile system. Starting in 2024, the IRS has also removed Copy-C from the 1099-NEC, so use Helper to save digital copies, too!\u003cbr\u003e\u003cb\u003ePackage Includes:\u003c\/b\u003e (3) 1096 Summary \u0026amp; Transmittal Forms"}

Items 1 to 6 of 6 total